Investor Relations

Building the Infrastructure Behind the Modern Accounting and Advisory Firm

SAM Technology is a U.S.-based financial operating system for CPA firms, advisory networks, and enterprise partners. We build the platform that powers tax, advisory, operations, and partner services, so firms can scale with confidence.

This page provides high-level information about SAM Technology for informational purposes.

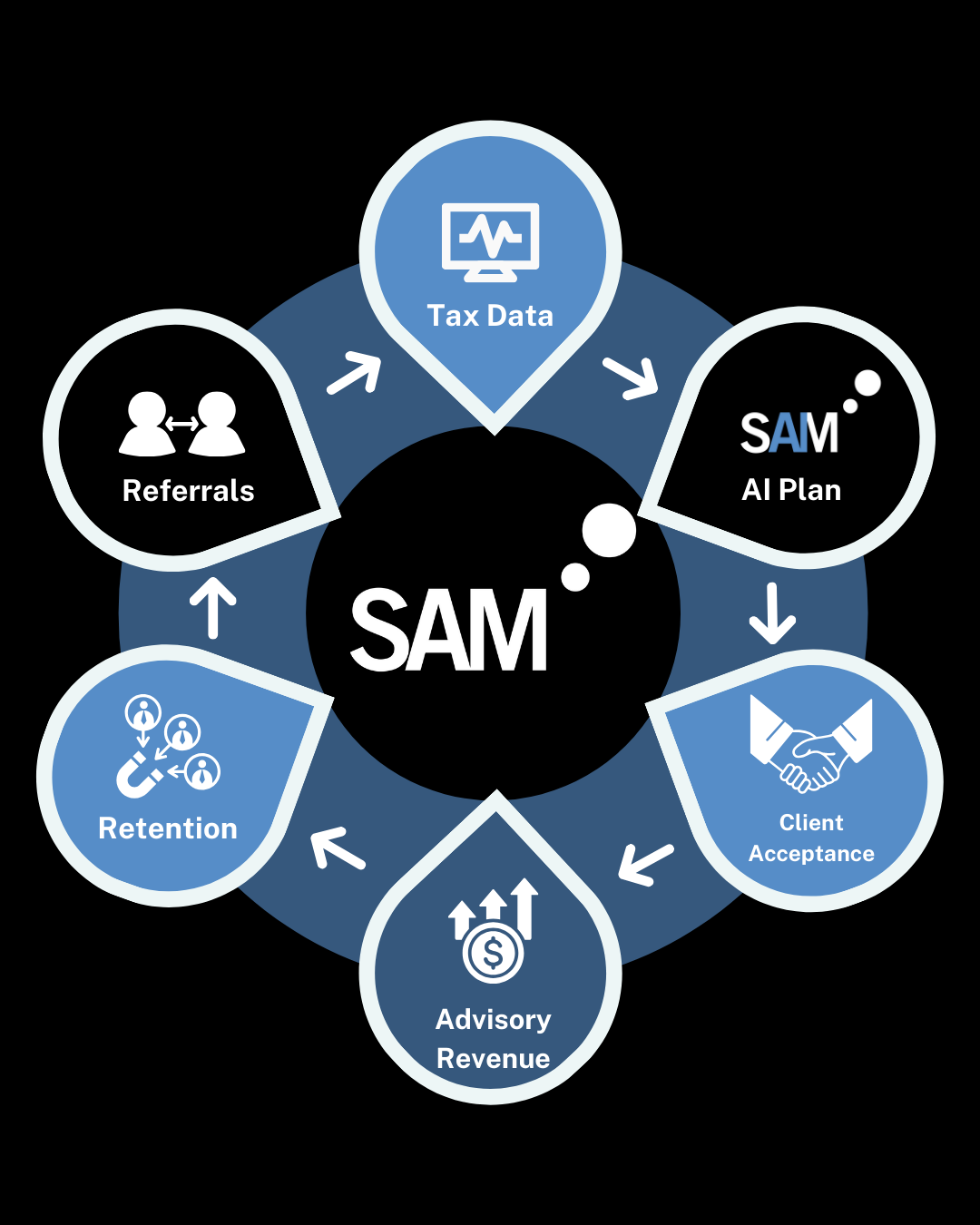

The SAM Platform

One system for tax, advisory, operations, and growth

SAM unifies the core systems firms need to operate a modern practice:

Tax and compliance workflows

Advisory and planning workflows

Secure document and data management

Payments, billing, and workflow automation

Partner services and integrations

All purpose-built for professional services firms.

We focus on infrastructure, not point solutions, so firms can reduce complexity, improve consistency, and build durable client relationships.

How SAM Creates Value

Designed for long-term firm success

-

Reduce operational friction and administrative overhead

-

Improve client experience and engagement

-

Expand advisory capabilities responsibly

-

Increase consistency and quality across engagements

-

Scale without increasing internal complexity

The platform is built to support firms over the long term, not to optimize for short-term volume.

Our Philosophy:

Technology should support professionals, not replace them.

We believe the future of professional services is:

Advisory-driven, not compliance-bound

Integrated, not fragmented

Human-led, not automated at the expense of trust

Built on relationships, not transactions

Every product decision at SAM is guided by these principles.

LEADERSHIP

Governance & Responsibility

Built for trust, resilience, and accountability

SAM Technology is a privately held company committed to responsible growth and operational discipline.

Our governance framework includes:

Internal financial oversight and reporting

Risk management and continuity planning

Regulatory and compliance alignment

Clear operational accountability

We focus on building a company that serves firms over decades.

Security & Data Info

Enterprise-grade security for sensitive financial data

SAM operates at the center of highly sensitive financial and personal information.

We maintain technical, administrative, and organizational safeguards designed to protect:

Confidentiality

Integrity

Availability

Security, privacy, and reliability are foundational to the SAM platform.

Our Ecosystem

Built with and for the professional services industry

SAM works with:

CPA and EA firms

Advisory and wealth management networks

Financial institutions

Strategic technology and service partners

Strategic & Investor Inquiries

For institutional and strategic stakeholders

SAM Technology does not make public offerings of securities.

Strategic, institutional, or partnership inquiries may be submitted by clicking the button below:

The information on this page is provided for general informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer would be made only through formal offering materials and in compliance with applicable securities laws.

Statements on this page may be updated or changed without notice and are not intended as guarantees of performance or outcomes.