Tax Return = Wealth Relationship.

Turn Every Tax Return into a Wealth Relationship

SAM is the financial operating system that helps RIAs turn tax data into year-round planning, higher AUM, and happier clients.

Pair your team with SAM AI and our U.S.-licensed CPAs and EAs to deliver coordinated tax AND wealth strategies under your brand.

Why RIAs choose SAM

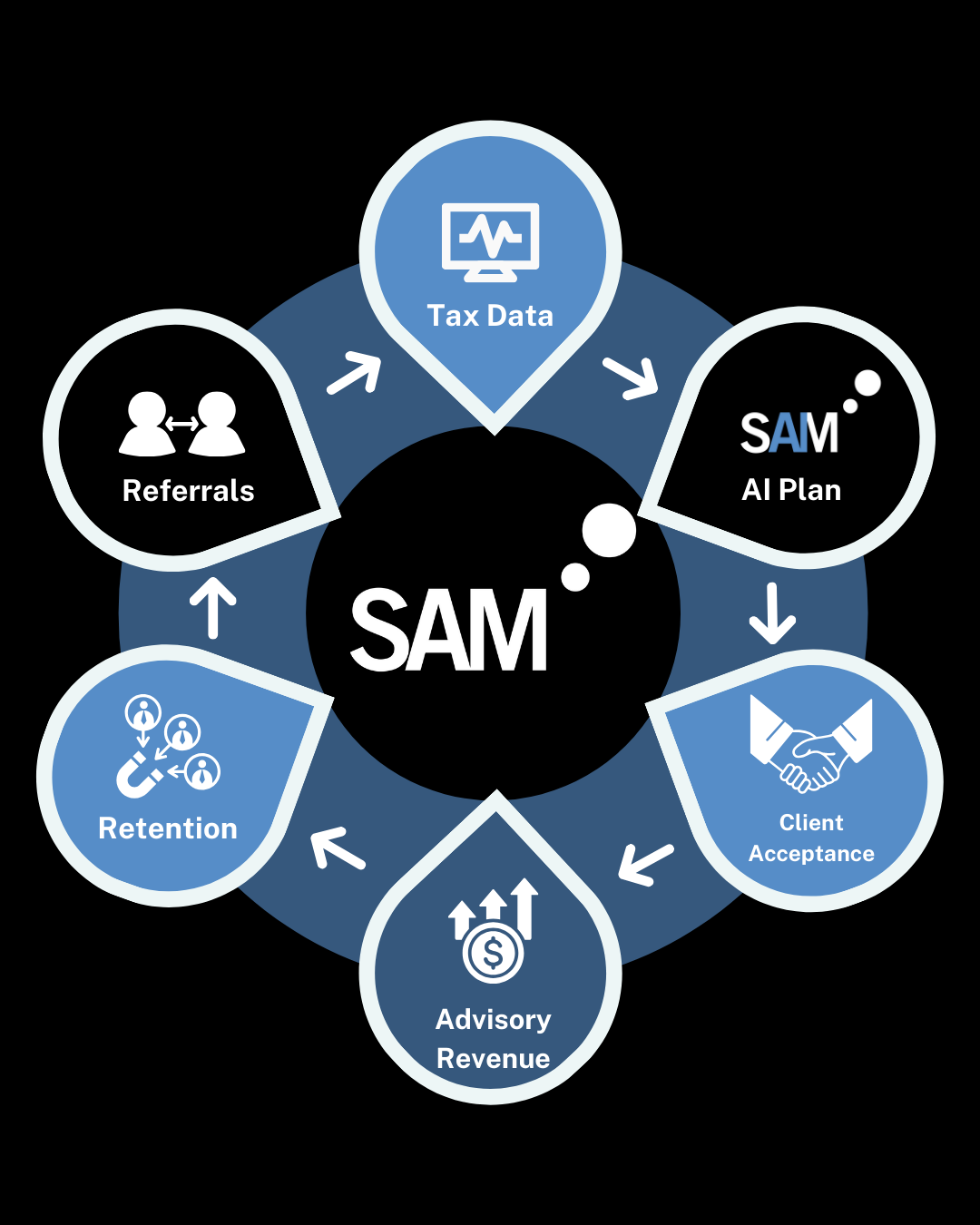

Tax-to-Wealth Flywheel

Convert 1040s and K-1s into specific planning plays that drive AUM growth.

White-Label Client Operating System

Collect documents, approve fees, and deliver plans inside your brand.

Advisory at Scale

SAM AI surfaces opportunities across your book so your team focuses on conversations, not data entry.

U.S.-Licensed Expertise

Plans are created and reviewed by senior U.S. CPAs and EAs.

Compliance-Friendly

Role-based access, audit trails, and exportable documentation for review and archiving.

Custodian-Agnostic

Works alongside your existing custodians, planning tools, and CRM.

Platform built for RIAs in the Advisor Share & Schwab ecosystems

SAM supports advisors across the Schwab Network and the Advisor Share IMO by delivering an AI-powered tax, wealth & estate workflow that boosts your team’s productivity and deepens client engagement.

With SAM’s AI-driven tax, wealth and estate workflows you’ll deliver

-

Tax Plans

Roth conversions, tax bracket management, gain harvesting and deferral, business entity elections, Augusta Rule, Section 199A, NUA, donor-advised fund timing, QCDs, QSBS viability review, multi-year projections.

-

Business Plans

Owner compensation design, S-corp vs. LLC modeling, cash flow and working capital, lending packages, succession roadmaps, valuation readiness, KPI dashboards.

-

Wealth & Estate Plans

Asset location and withdrawal order, concentrated stock strategies, charitable gifting, trust basics, beneficiary audits, estate document readiness checks.

-

Legal & Insurance (via Marketplace partners)

Estate documents (wills, revocable trusts, POA, AHCD), buy–sell agreements, entity formation and operating agreements, trust funding checklists; term & permanent life, disability income, long-term care (traditional & hybrid), key-person and buy–sell funding, P&C review coordination.*

*Delivered by licensed third-party providers; you remain the advisor of record. All engagements are fully documented for compliance.

How it works

-

Connect

Open a ticket or enable SAM’s Private Client Portal. Upload the latest return and notes.

-

Identify

SAM AI flags planning opportunities and groups clients by potential impact.

-

Plan

Our U.S. team prepares a client-ready plan. You approve before delivery.

-

Implement

Share next steps with clients, track tasks in your portal, and document outcomes for compliance.

RIA use cases

✓ Pre-retiree income bridge: Multi-year Roth conversions with IRMAA awareness and withdrawal sequencing.

✓ Business owner: S-corp election timing, accountable plan, family payroll, retirement plan selection, buy-sell coordination.

✓ Charitable client: Highly appreciated stock to DAF, QCD coordination, bunching strategy, estate alignment.

✓ Concentrated equity: 10b5-1 selling plan, gain management, gifting vs. donation pathways, basis tracking.

Security & Data Info

• SAM values your firm's AND client's security and privacy. That's why we have developed a Banking-Grade TLS 1.3 Encrypted platform ensuring safety and security from potential cyber risks.

• Most up-to-date security protocol supported by a large range of internet browsers such as Chrome, Safari, Edge, Firefox, and IE6. All sensitive data including passwords, files, and credit cards are 256-bit encrypted and stored at rest.

• SAM stores encrypted data in "Allow-Only" lists allowing access only to known server connections.

• Access Keys and Passwords use one-way hashing and a zero-knowledge approach, making them impossible (Including SAM) to determine once stored.

• SAM uses artificial and business intelligence to improve security, function, and simplicity in real time.

• SAM's Engineering team has over 25+ years in global software management and Cybersecurity.

FAQs

-

No. SAM is a planning and operations platform that supports your advisory work. You remain the advisor of record.

-

Choose firm-paid or client-paid. Many firms use firm-paid for core planning and client-paid for deeper projects.

-

Yes. You approve deliverables in your portal. Nothing is released without your sign-off.

-

Yes. SAM supports role-based permissions, audit trails, and exportable records for your compliance team.

-

Yes. Share client files with outside CPAs, or tap SAM’s U.S. CPA network when you need capacity.