Your Firm + Our Software

Change the way your accounting firm does business forever with SAM Technology's Private Client platform.

AI-Advisory Workflow

•

Advisory Upsides

•

Faster Close

•

Client-First UX

•

Prep → Advisory

•

Revenue Engine

•

AI-Advisory Workflow • Advisory Upsides • Faster Close • Client-First UX • Prep → Advisory • Revenue Engine •

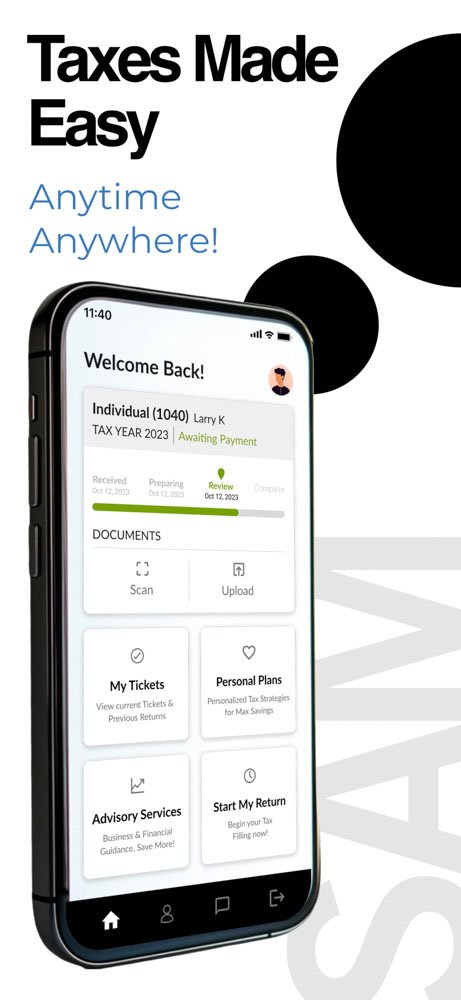

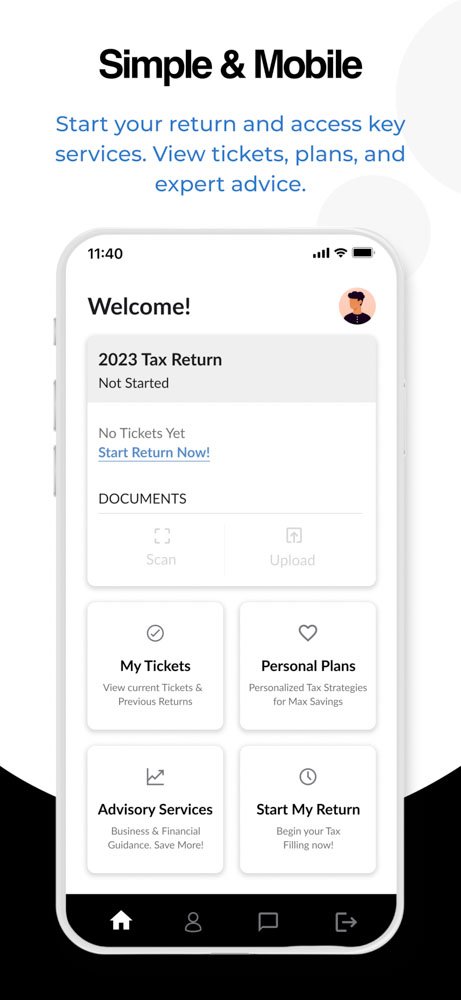

SAM Private Client Portal

Transform every return into an advisory conversation

The Private Client Portal powered by SAM turns client data into billable advice. Package recommendations, surface upsell signals with SAM AI, and move from one-off returns to recurring advisory, while payments are handled securely in-portal.

Tax to Advisory Made Easy

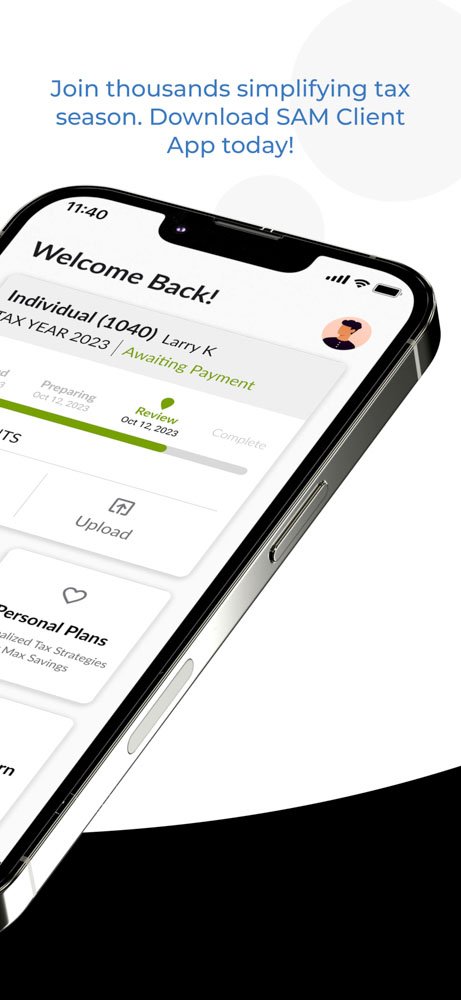

Download the App for iOS:

Why choose Private Client Portal powered by SAM?

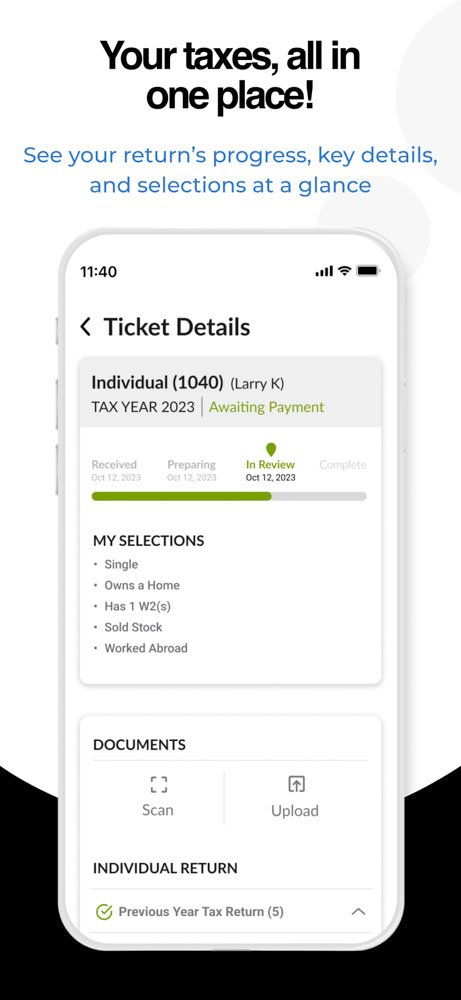

✓ Advisory Pipeline: SAM AI scans client data to surface tax, wealth, and entity-planning opportunities you can bill.

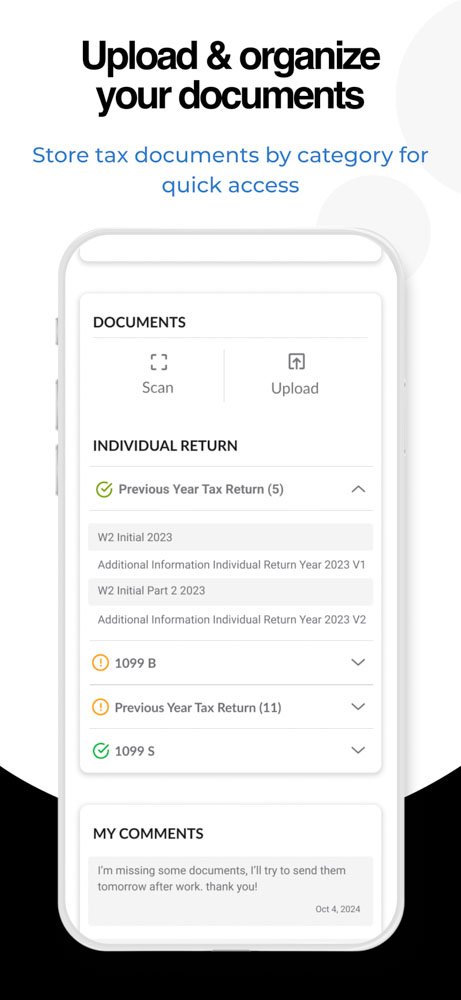

✓ Built-In File Management: Easily manage and track client documents with our secure, organized file management system.

✓ Secure Payment Processing: Reduce accounts receivable and work in process with a built-in payment gateway that requires payment before work begins.

✓ Customizable Billing: Tailor fee options to match your firm's billing and business model, ensuring flexibility and control.

✓ Elevated Customer Experience: Provide your clients with a seamless, branded experience that enhances satisfaction and loyalty.

Key Features

Branded Experience: White label your firm's interface, ensuring a consistent and professional client experience across all touchpoints.

SAM AI: SAM can automatically identifies upsell opportunities for business advisory services, driving more revenue with less effort.

Payment Gateway: Ensure timely payments by requiring clients to pay through the secure payment portal before work begins, reducing AR and WIP.

Custom Permissions: Set up customizable permissions to allow different employees within the firm to have specific responsibilities, controls, and viewership.

How It Works

-

Step One

Login/Signup

-

Step Two

Click “Private Client Portal”

-

Step Three

Send request to SAM

-

Step Four

Set up firm branding

-

Step Five

Set up engagement letters

-

Step Six

Add customers and invite them to your portal (Messaging will have your firm’s branding)

-

Step Seven

Once your clients accept, they’re added and ready to go

-

Step Eight

You may adjust fees per client once they are added

Ready to elevate your firm?

FAQs

-

Private Client Portal is SAM Technology’s proprietary software platform designed to integrate into accounting firms, offering enhanced customer experiences, streamlined workflows, and powerful built-in features like SAM AI and AutoPilot.

-

Private Client Portal includes a built-in file management system that allows clients to securely submit source documents through a bank-grade secure pipeline, speeding up the process and ensuring accuracy.

-

Yes, Private Client Portal allows firms to customize fee options and the payment gateway to reflect their billing and business model. Clients are required to pay before work begins, reducing accounts receivable and work in process.

-

Private Client Portal uses bank-grade security protocols to protect client documents and payment information, ensuring that all data is handled with the highest level of security and confidentiality.

-

Yes, SAM's Private Client Portal is fully customizable to reflect your firm's branding, ensuring a seamless and professional experience for your clients. You can customize the interface, payment options, and client communication to align with your firm's identity.

-

The Private Client Portal allows you to set up customizable permissions for different employees within your firm. You can control access to specific features, documents, and client information, ensuring that each team member has the appropriate level of responsibility and viewership based on their role.

-

The Private Client Portal includes an integrated payment gateway that requires clients to pay the firm’s fee before any work begins. This ensures that your firm receives payment upfront, reducing accounts receivable and work in process, and improving cash flow.